Construction has begun on Japan’s first casino, which is scheduled to open in 2030. In this article, we outline the key facts you need to know and the business opportunities that will emerge as the casino prepares to launch.

1. Project Snapshot

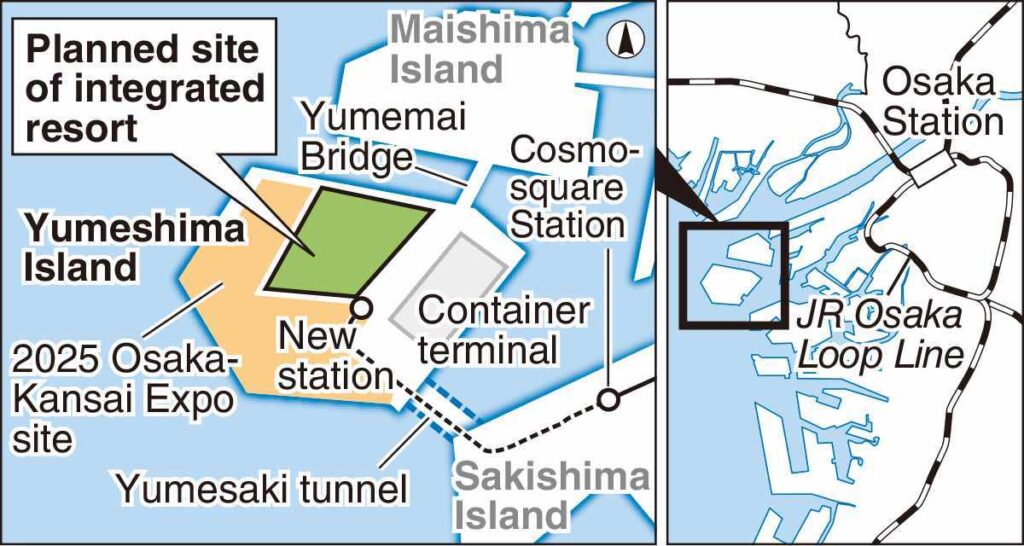

Location: Yumeshima, a reclaimed island in Osaka Bay, next door to the Expo 2025 grounds.

Scale: 49 ha site; 770 km² total gross floor area, including casino, three luxury hotels (~2,500 keys), a 6,000-seat arena, large-scale MICE center, shopping, museums and waterfront ferry terminal.

Opening target: Autumn 2030 following the April 2025–Oct 2025 World Expo.

2. Ownership & Governance

All stakes sit inside Osaka IR KK, the single-purpose operator required by law.

The actual stakeholders are as follows:

| Entity | Equity | Notes |

|---|---|---|

| MGM Resorts International (US) | 40 % | Global IR operator, contributes brand, systems & management |

| ORIX Corp. (Japan) | 40 % | Financing & domestic networks |

| Local partners (Panasonic, NTT West Japan, Kansai Electric Power, Kintetsu Group Holdings) | 20 % | Kansai-based corporates & financial institutions |

3. Capital & Financials

Initial capex: ¥1.27 trn (≈ US $8.9 bn).

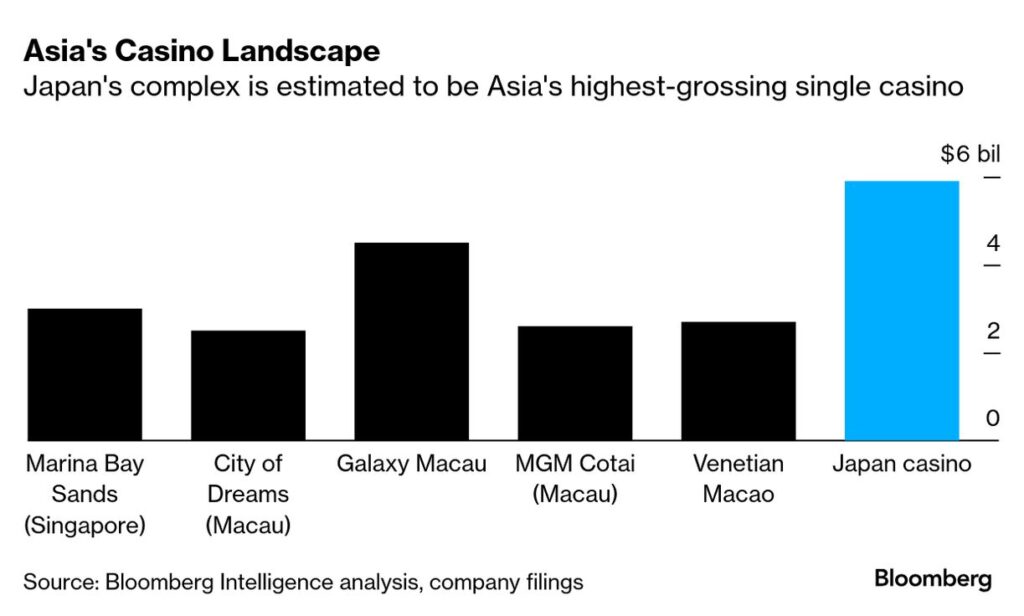

Expected gross gaming revenue (GGR): ≈ US $5.9 bn p.a., which would rank the resort third world-wide after Las Vegas & Macau. Moreover, it is expected to become the largest single casino in Asia.

Population catchment: ~20 million residents within 90 minutes by rail, plus Kansai’s international airports.

4. Tax & Fee Landscape

| Item | Rate / Amount | Who Pays | Where It Goes |

|---|---|---|---|

| National casino tax | 15 % of monthly GGR | Operator | Central govt. |

| Municipal casino tax | 15 % of monthly GGR | Operator | Osaka Pref. |

| Entry fee(Japanese and residents in Japan) | ¥6,000 per visit (¥3,000 national + ¥3,000 Osaka) | Japanese citizens & foreign residents | Govts. |

| Entry fee (tourists) | Exempt | Short-stay foreign passport holders | – |

5. Key Regulatory Points

Only one IR licence is approved nationwide so far – Osaka. Competing bids (e.g., Nagasaki) were rejected in Dec 2023 over funding concerns.

Casino floor capped at 3 % of the resort’s floor area; strict monthly visit limits for residents (max 10 entries).

Shareholders acquiring ≥ 5 % of the operator require Japan Casino Regulatory Commission clearance.

Non-resident foreigners may purchase chips on credit cards; ATMs inside the casino are prohibited.

6. Infrastructure & Access

Yumeshima Station (Osaka Metro Chūō Line) opened Jan 2025; extension delivers a direct 25-min ride from central Osaka.

Additional over-ground rail link and highway ramps are planned before the 2030 launch.

50-minute limousine-boat service to Kansai International Airport is included in the site plan.

7. Policy Head-winds to Watch

| Issue | Business Impact | Status |

|---|---|---|

| “City-entry fee” on foreign tourists | Could add ¥ hundreds per arrival; minor cost but signals tighter tourism policy | Under study; target before Expo 2025 |

| Article-10 renewals | IR implementation plan must be re-approved by the Osaka Assembly every 5/10 years – political risk | Built into legislation |

| Soil-remediation & land liquefaction | Potential capex overruns/delays | Mitigation measures built into design; monitoring ongoing |

8. Commercial Opportunities for Overseas Firms

| Opportunity Area | Description |

|---|---|

| Pre-opening procurement (2025-2029) | Fit-out, security technology, smart-building systems, and green-energy solutions required before opening. |

| MICE & hospitality partnerships | 6,000-seat arena and ~60,000 m² of conference/exhibition space aimed at international conventions that currently bypass Japan. |

| Food & beverage | Operator plans to allocate > 20 % of retail footprint to foreign cuisine and celebrity-chef concepts. |

| Fin-tech & AML solutions | Japan mandates real-time transaction monitoring and facial-ID; foreign vendors with Macau/Singapore experience are sought. |

| Adjacency plays | Logistics services, yacht/heli charters, and urban-air-mobility pilots linked to the bay-front location. |

| Regional tourism spill-over | Osaka’s links to Kyoto, Nara, Hyōgo, and Shiga will drive extended stays to historic cities and onsen resorts, boosting Kansai-wide demand. |

| Luxury retail & duty-free build-out | Pop-up boutiques, VIP personal-shopping lounges, and expanded tax-free zones targeting high-spend overseas guests. |

| Premium real-estate development | Branded residences, five-star serviced apartments, and trophy hotels fueled by rising land values around the IR. |

| Gaming-talent pipeline | Dealer academies, security-tech training, and hospitality schools to meet strict staffing and compliance rules. |

| Multilingual CX / BPO hubs | 24/7 AI-assisted call centres and live-interpreting services for seamless support to diverse guests. |

| Tourism super-apps | Mobile platforms bundling transport, lodging, tours, and cashless payments to promote regional circulation and capture data. |

| eSports & immersive entertainment | Tournament arenas, AR/VR attractions, and live-stream studios that draw Gen-Z and families beyond the gaming floor. |

| Medical & wellness tourism | Executive health checks paired with onsen retreats and cutting-edge treatments for East Asia’s growing “treat-and-travel” market. |

| Cultural & creative programming | Traditional-craft workshops, Kabuki/Noh residencies, and art fairs that lengthen stays through hands-on experiences. |

| Data-analytics & marketing SaaS | Unified guest-profile platforms enabling hyper-targeted promotions and loyalty across hotel, gaming, and retail silos. |

| Sustainable infrastructure | Circular-waste systems, smart-water, rooftop PV plus storage meeting 2030 ESG mandates and local goals. |

| Public art & placemaking design | Signature installations and branded landscapes that enhance destination appeal and Instagram-ability. |

| Advanced security & resilience | Drone patrols, crowd-flow analytics, and disaster-ready BCP consulting for large-scale venue risk management. |

9. Entry Checklist for Investors

- Prepare exhaustive due-diligence packs: background checks extend to ultimate beneficial owners & key staff.

- Factor in dual-tax structure when modelling returns (corporate + casino taxes).

- Plan for yen funding swings: operator aims for a 50 % debt/50 % equity mix; local syndicate tranches likely yen-denominated.

- ESG compliance matters: Osaka Prefecture requires quarterly social-impact reporting (problem-gambling, local hiring, carbon footprint).